Non-resident renters in tourism – Tax status and administrative obligations in Croatia

Who are non-residents?

Under the Croatian Income Tax Act, a non-resident is defined as an individual who neither has a permanent residence nor a habitual residence in Croatia, yet earns income within the country that is taxable under Croatian law. However, regardless of the officially registered place of residence, a person who is not a taxpayer in the Republic of Croatia does not have the same tax obligations as a resident.

What about rental activity in tourism?

A decision granting permission to provide hospitality services in private accommodation, commonly known as a Categorization Decision, can be obtained by Croatian citizens as well as citizens of EU/EEA member states and the Swiss Confederation.

However, the Hospitality Services Act stipulates that citizens of third countries (non-EU/EEA) cannot offer hospitality services in private accommodation in Croatia unless they establish a business, such as a sole proprietorship (obrt in Croatian) or company.

Non-Residents Renting Property in Croatia

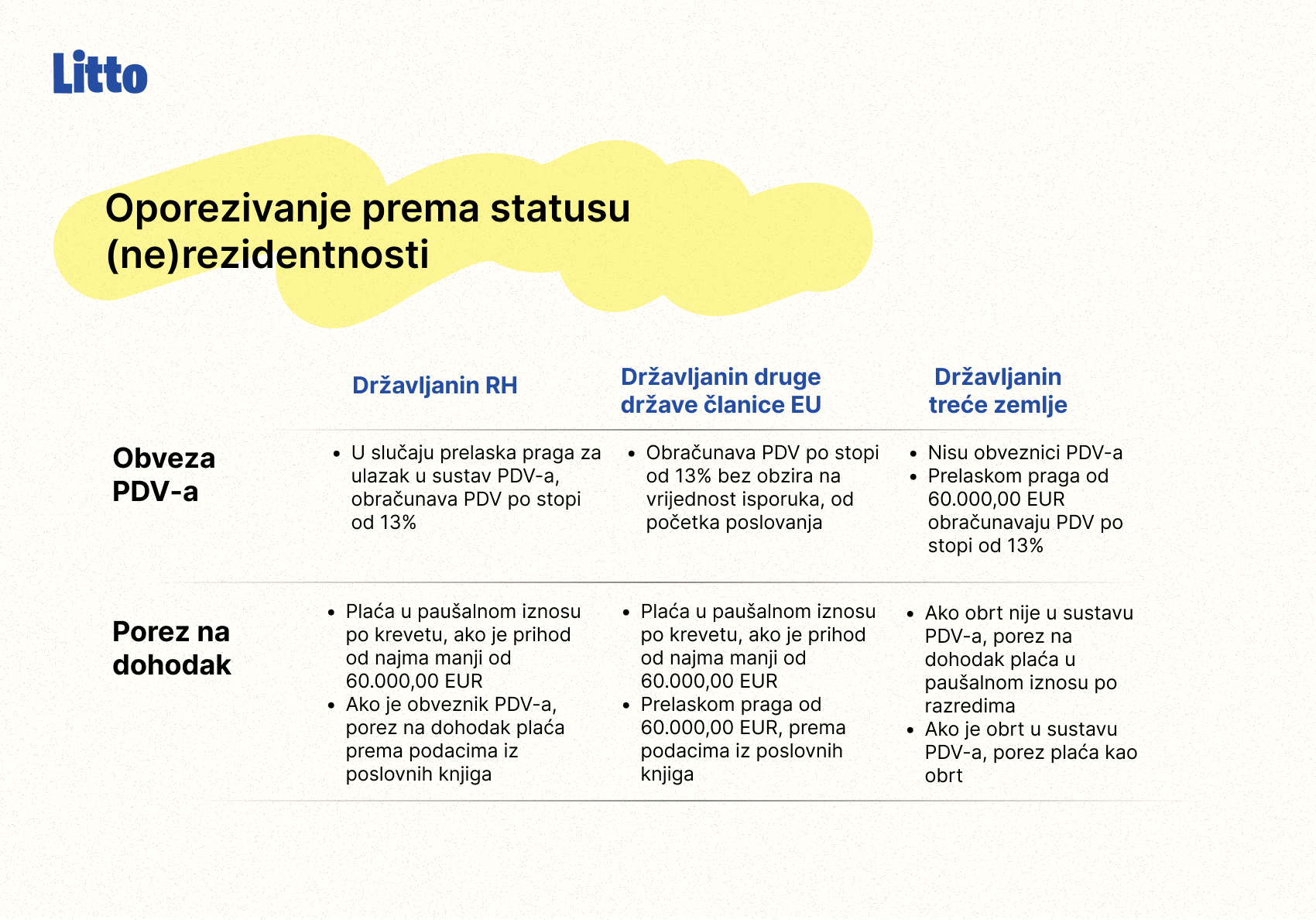

Non-residents who earn income through short-term property rentals in Croatia are subject to obligations under both the Income Tax and Value Added Tax (VAT) regulations.

Specifically, EU citizens who operate as landlords in Croatia must register for VAT purposes.

How Is This Different From Local (Resident) Renting?

Foreign taxpayers who wish to rent out their Croatian property do not hold the same tax status as Croatian residents. Therefore, there are important differences in their obligations that must be understood to ensure compliance with Croatian tax law.

VAT Registration

Non-resident vacation rental owners from EU countries must register for VAT immediately upon beginning rental activity. The standard VAT threshold of €60,000 does not apply to them.

They must register with the Croatian Tax Administration at least 15 days before starting their rental activity.

The registration request must be submitted to the Zagreb Regional Office, Department for Foreign Taxpayers, using Form P-PDV. Once registered, they are assigned a Croatian VAT ID number.

Suppose non-resident renters in tourism fail to register or respond to notices sent by the Tax Administration. In that case, authorities will estimate their tax liability and may initiate misdemeanor proceedings under the General Tax Act.

What Does This Mean Administratively and Financially?

Unlike residents (who may remain outside the VAT system if their annual income is below €60,000), non-resident landlords must apply a 13% VAT rate on accommodation services and 25% VAT on other services (e.g. cleaning fees).

Non-residents are also entitled to VAT input deductions on incoming invoices, which must be listed in monthly VAT and incoming invoices register, reducing their VAT liability. These invoices must include the taxpayer’s details: full name, address, and Croatian tax ID (OIB), and are only valid from the date the Categorization Decision is issued.

Landlords can handle these submissions themselves or hire an accountant. All forms can be submitted online via ePorezna(the Croatian tax portal). If a third party submits them, the landlord must authorize them through the system.

Flat-Rate Income Tax

Even though they must register for VAT, non-resident landlords are also subject to the flat-rate income tax, just like resident landlords. This is paid quarterly based on fixed deadlines. The amount is determined by the local government authority based on the number of beds.

The annual flat-rate income taxis calculated by multiplying the number of basic beds by the tax rate per bed, and is increased by the applicable local surtax—regardless of the landlord’s residence. The tax cannot be lower than €19.91 or higher than €199.08 per bed. If the local authority does not set a rate, the default is €99.54 per bed.

Paying Income Tax

At the beginning of each year, the Tax Administration sends landlords a decision detailing their total income tax due, payable quarterly by:

- March 31

- June 30

- September 30

- December 31

If a landlord’s income exceeds €60,000, income tax must be calculated based on accounting records rather than a flat rate.

Tourist Tax and Membership Fee

Both the tourist tax and the tourist board membership fee are paid as a flat rate. Payment slips and details can be accessed through eVisitor, which is also used for registering guest stays. The same rules apply to both residents and non-residents unless the income exceeds €60,000.

What About Non-Resident Landlords From Third Countries?

Non-residents from non-EU/EEA countries must establish a business (either a sole proprietorship or a company) in Croatia to rent out property, as required under Article 28 of the Hospitality Services Act. Once they do so, they have the same tax obligations and rights as Croatian residents, and are treated as residents for tax purposes.

They also follow the VAT threshold for small taxpayers and are not required to register for VAT until their income exceeds €60,000.

However, they must calculate income in accordance with either the Income Tax Actor the Corporate Profit Tax Act, depending on their business type.

EXCEPTION: Non-resident landlords from third countries who also holdCroatian citizenship (dual citizens) are treated the same as EU citizens. They do not need to establish a business but must register for VAT if they rent directly to guests and can pay income tax on a flat-rate basis.

Can Resident Landlords Opt Into the VAT System?

Yes. Resident landlords can enter the VAT system:

- Voluntarily– by submitting Form P-PDV, regardless of income level. They must stay in the VAT system for 3 years.

- Mandatorily– if they earn more than €60,000, they are automatically entered into the VAT system starting the following month. The flat-rate tax option is then revoked, and they must begin keeping accounting records and paying tax accordingly.

Entry into the VAT system does not require starting a business—they may continue operating as individuals. However, under Article 82 of the Income Tax Act, they must maintain accounting records and pay income tax accordingly.

Does all of this sound a bit complicated?

Don’t worry — get in touch with us by email at info@litto.agencyto schedule a meeting with one of our experts and discuss potential cooperation.